10 Steps to become an Entreprenuer

The last day of a recession is the best day to start a business, the saying goes. So tackle the 10 steps in this guide now - and be ready to ride the rebound when it comes.

Step 2: Have a cushion

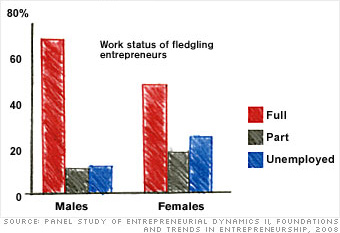

Indeed, most entrepreneurs work through the planning process; see chart. The obvious benefit of doing so: You continue to pull in a salary. That means you're buying yourself time to build a bigger launch fund. (And in this economy, the less you have to borrow to start up, the better.) Besides, you'll want to be tucking away, at minimum, six months of family living expenses and six months of business operating expenses for when you are ready to quit, says Anita Campbell, who runs Smallbiztrends.com. Twelve months would be, well, twice as good. Finally, if you end up finding out that the world isn't ready for your big idea, hey, at least you'll still have your day job.

One important caveat: If your company can make any claim to work, products or intellectual property created while you were employed, you may want to quit before the planning begins. But better make sure you've built that cushion before you do.

Among the growing camp of people who were given a pink slip? You may want to get a part-time job--any job--so you can slow your severance burn rate.

Step 3: Leverage your expertise

That's not to say that you should give up on an idea if you don't know the market. But at least give yourself a shot by choosing a field that's in demand (bottom right of the box). Especially during a tough economy, you want to focus on customers' current needs, with your edge being that you deliver a product or service faster, better or cheaper, says Edward Hess, professor at the Darden Graduate School of Business at the University of Virginia and co-author of So! You Want to Start a Business? You may also want to shift yourself up to the top-right quadrant by teaming up with someone who does have expertise. Or consider working in the industry to study up and taking any classes that will push you forward.

Step 4: See what the customer thinks

The most amazing idea may not be a viable business for any number of reasons. Customers might not perceive a need for it, for example. Or there may be too many players already.

The best way to find out if prospective customers will buy in? Ask them. Check out SurveyMonkey.com, which enables you to build, send and tabulate results of an online survey. (You can collect 100 responses for free and 1,000 for $20 a month.)

For a survey to be useful, you've got to send it to the right people. Contact a relevant trade association to see if the group knows of a targeted list you could buy (cost: about $75 to $125 per 1,000 names). Or befriend a blogger in the field, and ask that person to link to your survey, Slim suggests.

Don't forget to ask potential clients these key questions: How much would you pay for this product or service? And how often would you buy it?

Step 5: Write a winning business plan

There are countless books and computer programs to help you through this step. Among the better ones: Business Plan Pro software ($100 standard, bplans.com) and"The One Page Business Plan for the Creative Entrepreneur" ($35 for the book and the CD, onepagebusinessplan.com). At a minimum, your plan should include:

1. Company description:What is your product or service? What is your expertise?

2. Market analysis: Who - and how big - is your target audience? Who are your competitors? What edge do you have over them? How will you get their customers to switch allegiance to you?

3. Price analysis: What are your production costs? What does your research show about what customers are willing to pay? Can you sell enough at that price to give you a sufficient profit margin?

4. Marketing plan: How will you reach customers? How much will it cost?

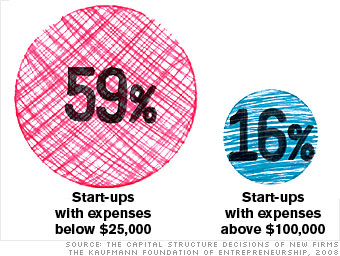

5. Funding and financials: How much funding do you need to get started? (Use the calculator at bplans.com to estimate this.) How will you use it? What are you projecting in terms of sales for the first few years? How much profit will that give you?

Step 6: Pick your advisers carefully

A C.P.A. If you have a simple business with limited expenses, say consulting, you might be fine with small biz software from TurboTax or TaxCut. But if you'll have a lot of costs or a payroll, hire a certified public accountant, who can help you time purchases, set up billing systems and file taxes. Get references from other business owners or do a search at cpadirectory.com.

A lawyer. You may want an attorney to help structure your business. And you'll definitely want one if there are licenses involved or if you'll be signing or writing complicated contracts. Again, get references from other small business owners.

A mentor. Don't have someone to bounce ideas off of? Make contacts via your local Small Business Development Center (SBDC). A joint effort of the U.S. Small Business Administration, universities and private-sector volunteers, SBDCs offer classes and counseling. Go to sba.gov and search "SBDC Locator." Or try SCORE (score.org), a nonprofit staffed by small biz vets.

Step 7: Make it official

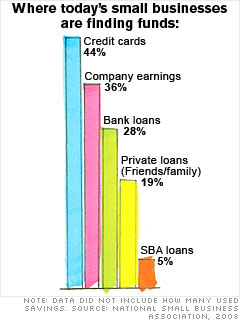

Step 8: Chase the moola

CASH/SAVINGS

Good choice if... ...you have the money. Can't beat the 0% interest.

bad choice if... ...your only way to get cash is to tap your emergency or retirement funds.

FRIEND AND FAMILY LOANS

Good choice if... ...they'll agree to it. So no one incurs taxes, make sure they charge you the "applicable federal rate"--recently 1.4% to 5.8%, depending on the term; find it at irs.gov--on loans above $12,000.

bad choice if... ...your generous relative isn't also forgiving. Some 14% of these loans end up in default, according to a study by peer-to-peer loan facilitator VirginMoney.

HOME EQUITY LINE OF CREDIT

Good choice if... ...you have a lot of equity and need a little. A FICO score above 700 and at least 20% equity is key to getting approved. Rates average 5.3% (variable) and are falling.

bad choice if... ...you have little equity or home values are falling a lot in your area. Also, since your home is the collateral, don't take this loan on if there's a chance you'll default.

BANK LOAN

Good choice if... ...you can get one. It's especially hard for start-ups to qualify. Community banks and credit unions are your best bets. With a FICO score of 700 and collateral, expect a fixed rate of 5% to 10%.

bad choice if... ...there's any chance you'll default, since you typically need to put up collateral.

SBA MICROLOAN

Good choice if... ...you need less than $35,000 and can swing the 8%-to-13% rates. Your Small Business Development Center should have leads on which local nonprofits make these loans.

bad choice if......you can't swing the interest rates.

CREDIT CARD

Good choice if... ...you can get a low rate (the average is now 11%) and are sure you will never ever miss a payment. Penalty rates can go up to 36%.

bad choice if... ...you're flaky with bills, lack the willpower to pay more than the minimum or can't get a low-rate card.

VENTURE CAPITAL/ANGEL INVESTORS

Good choice if... ...you have an innovative healthcare, tech or engineering idea that will generate some $50 million in sales yearly.

bad choice if......you don't have a big, big idea. Frankly, you have better odds of dying from a fall in the bathtub.

Step 9: Lure customers, on the cheap

1. Start with people you know. Word of mouth is a powerful tool. Ask friends to spread news of your biz. Use social-networking sites too. Facebook lets you start a page for your company, run promos and post polls. Sign up for Twitter, which lets you broadcast your doings; and use it to remind pals about your business, says Joe Cullinane, marketing executive in residence at Northern Illinois University.

2. Be where your customers are. If your clients are in a particular field, go to trade shows. To get your name out, "see if you can speak at an event," says Cullinane. Or ask a question in front of the crowd at panels and engage in discussions afterward.

If your clients are in varied industries, think about what other types of businesses they frequent. See if those firms will work out a reciprocal marketing deal.

3. Get some ink. Public relations is cheaper than advertising, so use press releases to get your business some buzz. PR Newswire offers a program allowing small biz owners to send releases to targeted groups of media and consumers (prtoolkit.prnewswire.com). One-time fees for the service start at $180 for state and city distribution, $680 for national.

4. Offer sweet incentives. Anita Campbell of Smallbiztrends.com suggests giving away something - doing a very small project on spec, for example. Another option: Break out a piece of your business into an inexpensive one-off purchase. "Build trust first and that can lead into a bigger purchase later," she says. Also, consider promotional offers, such as "Buy one, get the second half-off."

Step 10: Go 2.0

Focus on the message. You don't need a flashy site, says Derek Gehl, CEO of Internet Marketing Center, a small business training firm. "Instead, write sales copy that converts visitors to buyers." State clearly and concisely on the home page the benefits of your service or product. See what keywords people might search (use adwords.google.com/select/KeywordToolExternal) and work them into your copy.

Use testimonials. No customer base yet? Consider giving targeted groups of people your product for free in exchange for their reviews.

Drive people to your site. Get bloggers to link to you. Also, sign up for Google AdWords (adwords.google.com), "which helps your ads pop up along similarly named search results," says Cullinane. You pay per customer click, and you set a daily budget.

DON'T...

Forget why people have come. More than 50% of online sales are lost when customers can't figure out how to buy the product or service, according to research firm Gartner Inc. If you're selling online, put a "buy now" button on the home page and list a customer service number.

Let customers go. It's cheaper and more effective to market to previous buyers. Make sure you have a way to get contact info from even those first customers, Gehl suggests. That way you can start building the customer base that will make your start-up a success.

By Carla Fried

Additional Reporting by Alexis Jeffries contributed to this article.

Posted by Chismillionaire at 10:49 AM

1 comments:

http://www.mfg.com/usa/tramadolonline/#17982 buy tramadol online in usa - buy tramadol from usa

Post a Comment